|

|

|

||||||||||||||||||||||

|

Private Equity Pages: Benefits

to fund seeking companies Corporate Funding Pages: Loans: External

Commercial Borrowings General Pages: |

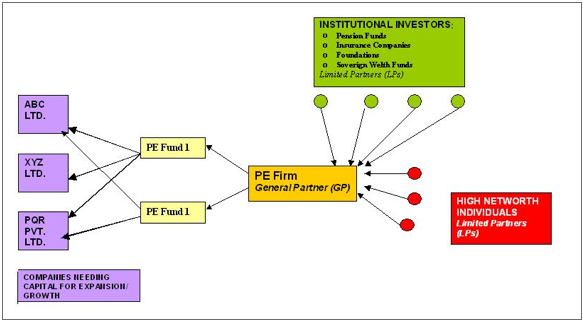

Structure

of a typical, PE Fund A Private Equity Fund is

usually set up and run by a professional, partnership firm. Institutional investors like, pension funds,

insurance companies, sovereign wealth funds, foundations, etc., join the firm

as Limited Partners (LPs), and contribute cash. The PE Firm usually contributes between

5-15% of the corpus while, the rest is pooled in by

LPs. The PE Firm will create various

funds, may be with different themes or focus, like “India Fund” or “Infrastructure

Fund”. These funds make

investments in investment seeking companies.

The illustration shows the typical structure.

Why should an unlisted company raise private equity in the

first place? What are the benefits

private equity vis-à-vis loans/ borrowings?

What are the risks? What could be the pitfalls? To know the answers to

these and innumerable questions, dig deeper. |

||||||||||||||||||||||

|

|

|||||||||||||||||||||||

|

I Our Team I Our Investment Banking Arm I

Our Clients I

Contact us I |

|||||||||||||||||||||||